idaho sales tax rate in 2015

Sales Tax Distribution by County for 122015 01-19-2016 County-City BaseExcess. Find your pretax deductions including 401K flexible account.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

This was the 36th highest combined sales tax in the country in 2015 and was the median or third highest among its neighboring states.

. Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Find your income exemptions. Plus 45 of the amount over.

If you need access to a database of all Idaho local sales tax. Idahos state sales tax was 6 percent in 2015. Idaho has recent rate changes Fri Jan 01 2021.

The Idaho State Tax Tables for 2015 displayed on this page are provided in support of the 2015 US Tax Calculator and the dedicated 2015 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. L Local Sales Tax Rate.

Click any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculator to lookup local rates by zip code. Enter zip code of the sale location or the sales tax rate in percent Sales Tax. A customer living in Sun Valley Idaho finds Steves eBay page and purchases a 350 pair of headphones.

The 95 sales tax rate in Los Angeles consists of 6 California state. Tax rates last updated in January 2022. Plus 31 of the amount over.

Average Sales Tax With Local. The Idaho State Tax Commission collects data and prepares reports on a range of topics. The Montana sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the MT state tax.

Idaho state sales tax. Exact tax amount may vary for different items. S Idaho State Sales Tax Rate 6 c County Sales Tax Rate.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Prescription Drugs are exempt from the. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

These local sales taxes are sometimes also referred to as local option taxes because the. The state sales tax rate in Idaho is 6000. Sales Tax Rate s c l sr.

Sales tax region name. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006. Sr Special Sales Tax Rate.

When calculating the sales tax for this purchase Steve applies the. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0. What is the sales tax rate in Idaho City Idaho.

With local taxes the total sales tax rate is between 6000 and 8500. So whilst the Sales Tax Rate in. The minimum combined 2022 sales tax rate for Idaho City Idaho is 6.

10 of the amount over 0. Boise Auditorium District Sp. The Idaho Department of Revenue is responsible for publishing the latest Idaho State.

How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table. Some Idaho resort cities have a local sales tax in addition to the state sales tax. For sales made on and after June 1 2019 a remote seller must register with the state then collect and remit Idaho state sales tax if the remote seller has cumulative gross receipts of more than.

Idaho state income tax rates range from 0 to 65. Calculate By Tax Rate or calculate by zip code. This is the total of state county and city sales tax rates.

278 rows Idaho Sales Tax. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. FUN FACTS Several Idaho resort cities and three auditorium community center.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. Calculate By ZIP Code or manually enter sales. The average local tax was about 001 percent meaning that the average combined sales tax was about 601 percent.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Sales Tax By State Is Saas Taxable Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

How To Charge Your Customers The Correct Sales Tax Rates

Sales Taxes In The United States Wikiwand

How To Charge Your Customers The Correct Sales Tax Rates

The Tax Burden On Personal Dividend Income Across The Oecd 2015 Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Property Taxes Make Up 40 Of State And Local Tax Revenues Eye On Housing

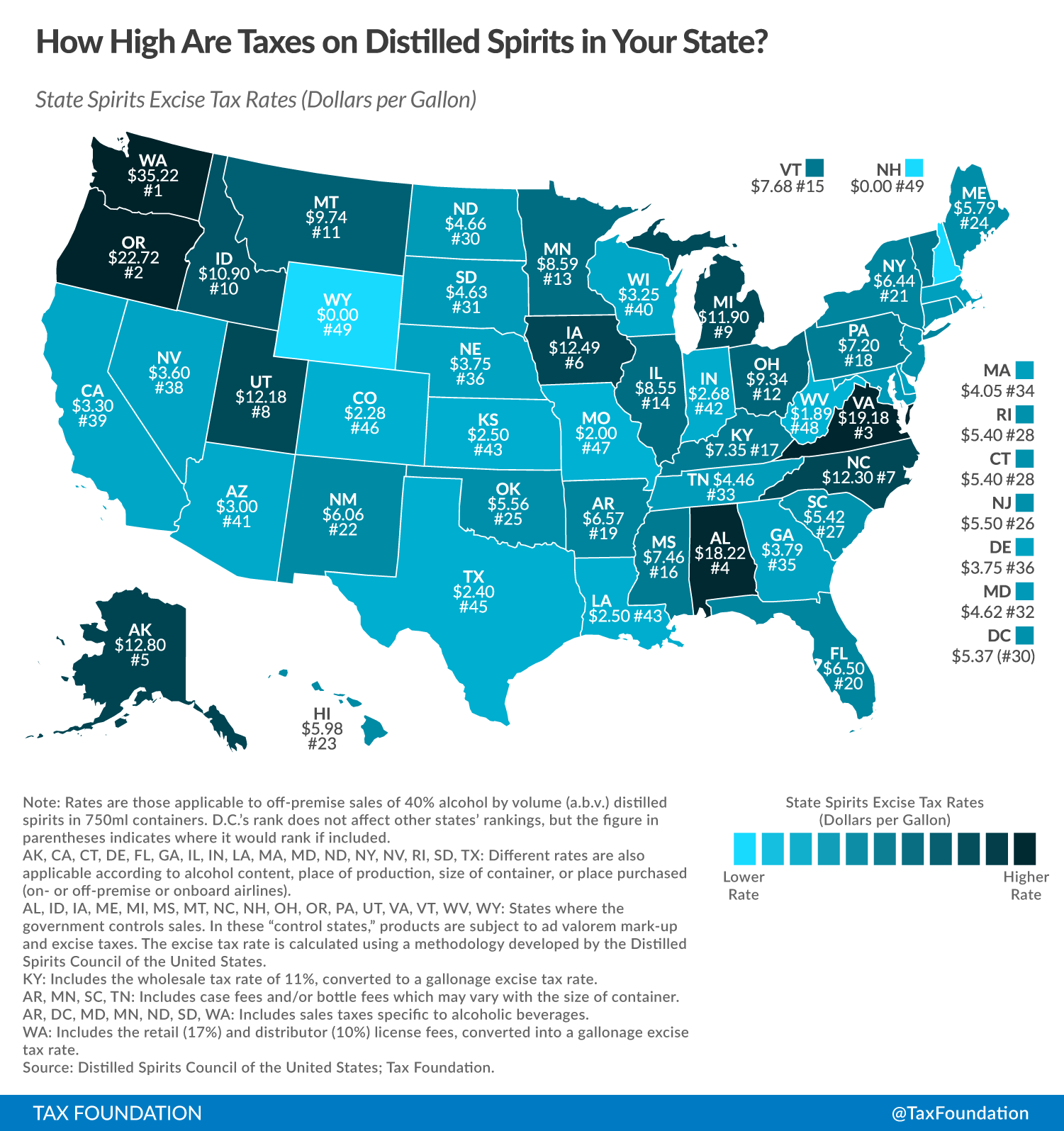

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Combined State And Local General Sales Tax Rates Download Table

The Tax Burden On Personal Dividend Income Across The Oecd 2015 Tax Foundation

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy